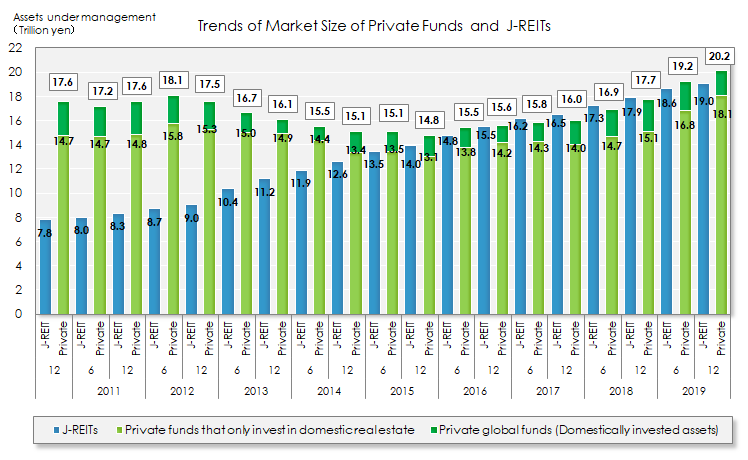

Starting in 2003, Sumitomo Mitsui Trust Research Institute Co., Ltd. has conducted the "Survey on Private Real Estate Funds" as part of its research activities concerning real estate investment markets. Based on the results of the survey, hearings and published information, we estimated the market size of private real estate funds (on an invested asset basis) as of the end of December 2019 to be 20.2 trillion yen.

Market Size of December 2019

[released March.18, 2020]

The market size of private real estate funds is 20.2 trillion yen including Japanese assets of global funds

• Based on the results of the survey, hearings and published information, we estimated the market size of private real estate funds (on an invested asset basis) as of the end of December 2019 to be 20.2 trillion yen. This figure involves Japanese assets of global funds (*) that we were aware of. Assets under management (AUM) increased approximately 920 billion yen (4.8%) from the previous survey (19.2 trillion yen as of the end of June 2019), exceeded 20 trillion yen and has replaced the past highest record. Although the pace of the expansion of the market for domestic private real estate funds slowed down slightly compared to the previous survey, which increased 1.5 trillion yen, the market continues to grow.

(*) We define "global fund" as a fund targeting real estate investments in various countries including Japan.

• The number of asset managers whose AUM increased exceeded significantly the number of asset managers whose AUM decreased. While the AUM of some asset managers significantly decreased primarily due to the end of fund management, there were more companies comprised largely of domestic asset managers whose AUM increased considerably. Overall, the market size we estimated rose approximately 4.8% from the estimate in the previous survey.

The appetite for investment in Hotel, Retail has decreased

• A noteworthy finding of this survey is that while the majority of the managers presumably believe that investors' appetite for investment is at a high level, responses by property type indicate an increase in responses that the appetite of both domestic and foreign investors for investment in hotels and retail is decreasing. Until the previous survey, the largest number of asset managers chose "Hotel" as the property type which the appetite of equity investors had been increased. However, it is likely that investors are increasingly becoming more cautious about investing in hotels due to a fall in demand for inbound tourism and a growing sense of oversupply in the market. Asset managers assuming a decrease in investors' appetite for investment in retail due in part to the consumption tax hike and growth of the e-commerce market appear to be increasing.

※It should be noted that this survey was conducted in January and early February 2020, prior to the increase in the impact of COVID-19 coronavirus, which will begin to appear in the next survey result.

(*)We define "global fund" as a fund targeting real estate investments in various countries including Japan.